Eligibility Criteria

Features and benefits

- Receive up to 50 litres of free fuel annually.

- Every INR 150 spent on any purchases entitles you to 1 Fuel Point.

- Save 2.5% on dining expenses.

The HDFC IndianOil Credit Card is a co-branded credit card targeted at people who frequently consume fuel and shop every day. This paper gives an in-depth review of the features and benefits that come with this card, based on user experience.

Details of the Card

Issuer: HDFC Bank in association with IndianOil

Card Type: Visa

Annual Fee: ₹500 + GST (waived on annual spends of ₹50,000 or more)

Joining Fee: Nil

Interest Rate: 3.49% per month (41.88% per annum)

Cash Advance Limit: Up to 40% of credit limit

Foreign Currency Markup: 3.5% + GST

Eligibility Criteria

The HDFC IndianOil Credit Card has been designed for those people who spend a lot on fuel every month and want rewards against everyday expenses. The eligibility criteria for this card are as follows:

- Age: 21-60 years

- Income: Minimum yearly income of ₹2 lakhs for salaried individuals

- Credit Score: Good credit score, usually 700+ preferred

- Employment: Salaried employee or self–employed professional

- Residence: Resident of India

Documents Required

For applying for the HDFC IndianOil Credit Card, you will have to provide the following documents:

- Application form with complete details

- Recent passport size coloured photograph

- Identity Proof: Any one (PAN Card, Aadhaar Card, Passport, or Voter ID)

- Address Proof (any one): Aadhaar Card, Passport, Driving License, or Utility Bill not older than 3 months

- Income Proof:

– For salaried: Latest 3 months’ salary slips and Form 16

– For self-employed: Income Tax Returns for the last 2 years and bank statements for the last 6 months

Card Features & Benefits

- Fuel Benefits:

- 5% Cashback on fuel purchases at IndianOil outlets

- Waiver of 1% fuel surcharge for transaction amount between ₹400-₹5,000

- 2.5% cashback on fuel purchases at all other fuel stations

- Rewards Program:

- 4 reward points per ₹150 spent on dining, grocery and utility bill payments

- 2 reward points per ₹150 spent on other categories

- 1% cashback on all other retail spends

- Welcome Benefits:

- 1,000 bonus reward points on first transaction within 30 days of card issuance

- Additional 1,000 bonus reward points on spends of ₹5,000 in the first 60 days

- Lifestyle Benefits:

- 1% cashback on movie ticket bookings through BookMyShow

- Upto 15% Dining discounts at partner restaurants

- Insurance Coverage:

- Personal accident insurance cover of ₹5 lakhs

- Zero liability protection on lost card

- Flexibility:

- EMI conversion facility for large purchases

- Balance transfer option from other credit cards

Card Description

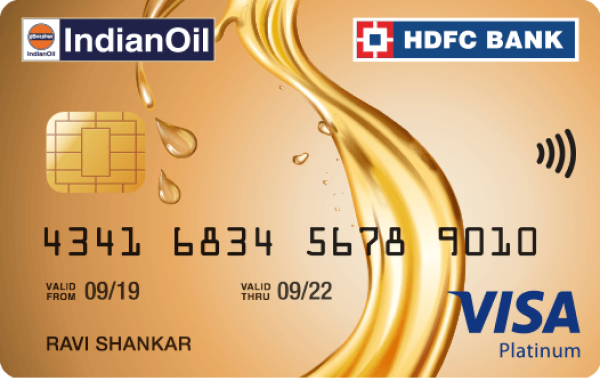

This HDFC IndianOil Credit Card comes in special telling design and evidences its co-branding with HDFC Bank and IndianOil. The face of the card is occupied majorly by an intense orange color characteristic of the IndianOil brand, while logos of HDFC Bank and IndianOil feature quite dominantly. The card number and the name of the cardholder are raised in silver and offer great contrast against the bright orange background.

This co-branded credit card is essentially aimed at heavy fuel consumers and helps them gain maximum savings on fuel costs. Still, it has an expansive rewards program to accommodate everyday use beyond fuel purchases.

The card is designed to maximize benefits on the fuel transactions at IndianOil outlets with a liberal 5% cashback. Hence, that would make this an excellent card for car owners, people who travel frequently, or use personal transporters extensively. Added to this is the waiver of 1% fuel surcharge to enhance savings on fuel purchases.

Other than the fuel benefits, the card comes with a tiered reward system to encourage spends on key life categories like dining, grocery, and utility bills. Hence, it makes the card flexible for daily use, giving cardholders the capability to accrue reward points on many transactions.

Added to this are value-added benefits, such as movie ticket cashback and dining discounts, which would make the card more rewarding for those who like entertainment and dine out. Compared with some premium cards, it simply does not provide that much insurance coverage, but still, it provides the basic protection which can be very helpful in times of need.

Overall Rating

Rating Breakdown

Reviews

Good

Recommend !